time:2024-05-16 source:动力电池网

Recently, the China Automotive Power Battery Industry Innovation Alliance announced the monthly data of power batteries in China for April 2024. In terms of production, driven by the demand for new energy vehicles, the production of power and other batteries in April increased both month on month and year-on-year. In April, the total production of power and other batteries in China was 78.2 GWh, a month on month increase of 3.2% and a year-on-year increase of 60.0%. From January to April, the total cumulative production of power and other batteries in China was 262.8 GWh, a year-on-year increase of 40.5%.

In terms of sales, in April, the total sales of power and other batteries in China were 73.5GWh, a month on month increase of 0.3% and a year-on-year increase of 57%. Among them, the sales of power batteries were 55.1 GWh, a decrease of 11.5% month on month and a year-on-year increase of 28.5%; The sales of other batteries were 18.4GWh, a month on month increase of 67.1% and a year-on-year increase of 370.1%. The sales of power batteries and other batteries account for 75% and 25% respectively.

Among them, in April, the sales of power and other batteries in China increased by 57% year-on-year, with Yiwei Lithium Energy, Ruipu Lanjun, Honeycomb Energy, and Weihong Power all exceeding the average growth rate; In April, the sales of power batteries in China increased by 28.5% year-on-year, with China Innovation Aviation, Honeycomb Energy, Ruipu Lanjun, and Weihong Power all exceeding the average growth rate.

From January to April, the cumulative sales of power and other batteries in China reached 241.2 GWh, a year-on-year increase of 41.4%. Among them, the cumulative sales of power batteries were 201.3 GWh, a year-on-year increase of 33.4%; The cumulative sales of other batteries were 39.9GWh, a year-on-year increase of 103%. The sales of power batteries and other batteries accounted for 83.5% and 16.5%, respectively.

In terms of loading volume, in April, the loading volume of power batteries in China was 35.4GWh, a year-on-year increase of 40.9% and a month on month increase of 1.4%. The installed capacity of ternary batteries was 9.9GWh, accounting for 28.0% of the total installed capacity, a year-on-year increase of 24.1%, and a month on month decrease of 12.2%; The installed capacity of lithium iron phosphate batteries is 25.5GWh, accounting for 71.9% of the total installed capacity, a year-on-year increase of 48.7% and a month on month increase of 7.8%.

From January to April, the cumulative installed capacity of power batteries in China was 120.6 GWh, a year-on-year increase of 32.6%. The cumulative installed capacity of ternary batteries is 40.8 GWh, accounting for 33.8% of the total installed capacity, with a cumulative year-on-year increase of 41.2%; The cumulative installed capacity of lithium iron phosphate batteries is 79.8 GWh, accounting for 66.1% of the total installed capacity, with a year-on-year increase of 28.6%.

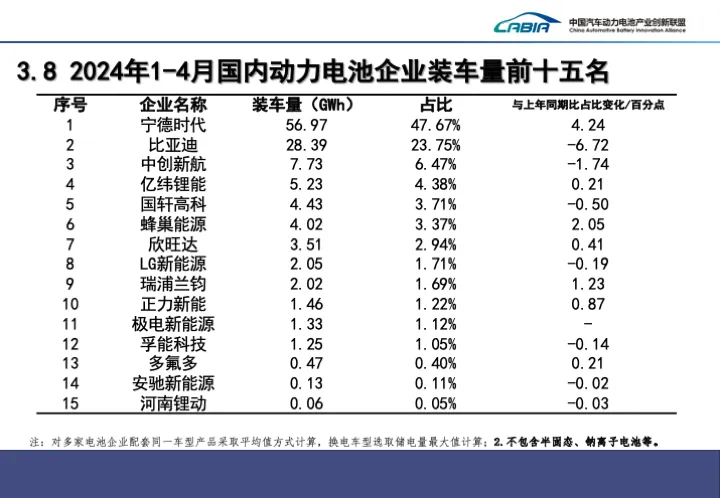

In terms of enterprises, in April, a total of 40 power battery companies in China's new energy vehicle market achieved vehicle installation support, an increase of 4 compared to the same period last year. The top 3, top 5, and top 10 power battery companies had vehicle installation volumes of 28.1 GWh, 30.9 GWh, and 34.2 GWh, respectively, accounting for 79.4%, 87.2%, and 96.5% of the total vehicle installation volume. The proportion of the top 10 companies decreased by 1.2 percentage points compared to the same period last year.

In April this year, the domestic power battery installation volume of Ningde Times reached 15.65 GWh, with a market share of 44.65%, still ranking first, but showing a slight decline compared to the previous month. BYD, ranked second, had a domestic power battery installation volume of 9.95 GWh in April, with a market share of 28.37%, an increase of 1.58 percentage points compared to the previous month.

China Innovation Airlines remained the third largest carrier in China in April, achieving a monthly loading volume of 2.54 GWh and a market share of 7.24%, a slight increase of 0.58% compared to the previous month. Yiwei Lithium Energy and Guoxuan High tech ranked fourth and fifth respectively with an installed capacity of 1.44 GWh and 1.31 GWh, with Yiwei Lithium Energy's market share of 4.11%, a decrease of 1.12 percentage points compared to the previous period. Guoxuan High tech's market share was 3.73%, an increase of 0.74% compared to the previous period.

Honeycomb Energy, Xinwangda, Zhengli New Energy, LG New Energy, and Ruipu Lanjun ranked sixth to tenth respectively. Except for Honeycomb Energy and Zhengli New Energy, the market share of other enterprises all declined in the previous month.

From January to April, a total of 47 power battery companies in China's new energy vehicle market achieved vehicle installation support, an increase of 5 compared to last year. The top 3, top 5, and top 10 power battery companies had vehicle installation volumes of 93.1 GWh, 102.7 GWh, and 115.8 GWh, respectively, accounting for 77.2%, 85.2%, and 96.0% of the total vehicle installation volume.

It is worth noting that from January to April, China achieved the installation of semi-solid batteries and sodium ion batteries, with supporting battery companies including Weilan New Energy, Ningde Times, and Funeng Technology. Among them, compared to the first quarter, the sodium battery field has added Funeng Technology for vehicle installation.

In terms of exports, in April, China's total exports of power and other batteries reached 12.7GWh, a month on month increase of 3.4% and a year-on-year increase of 28.5%. Among them, the export of power batteries was 9.0GWh, a decrease of 24.3% month on month and a year-on-year increase of 1.7%; The export of other batteries reached 3.7GWh, a month on month increase of 843.7% and a year-on-year increase of 259%. The export proportions of power batteries and other batteries were 70.9% and 29.1% respectively, with a total export accounting for 17.3% of the monthly sales.

From January to April, China's total exports of power and other batteries reached 41.5 GWh, a year-on-year increase of 5.5%. Among them, the cumulative export of power batteries was 37.1 GWh, a year-on-year increase of 8.2%; Accumulated exports of other batteries reached 4.4GWh, a year-on-year decrease of 12.9%. The proportion of power and other batteries is 89.4% and 10.6% respectively, with a total cumulative export accounting for 17.4% of the cumulative sales in the first four months.

In April, China's exports of power and other batteries increased by 28.5% year-on-year, with BYD, Funeng Technology, Honeycomb Energy, and Weihong Power all exceeding the average growth rate; In April, China's power battery exports increased by 1.7% year-on-year, with BYD, Funeng Technology, Honeycomb Energy, and Weihong Power all exceeding the average growth rate.